GaryK’s Quote on The Front Page Of @USATODAY

Looking for signs of stocks’ final washout as fear, panic spike

First came the Dow’s 565-point whoosh to the downside Wednesday. Then came the rebound rally that trimmed the Dow’s losses for the day to 249 points and which Wall Street hopes was the final washout — or so-called investor “capitulation” — that often signals the end of stock market pain.

Indeed, the relentless selling on Wall Street early in the new year had panicky investors running Wednesday.

Here’s proof investors wanted out and were headed for the exits? Consider:

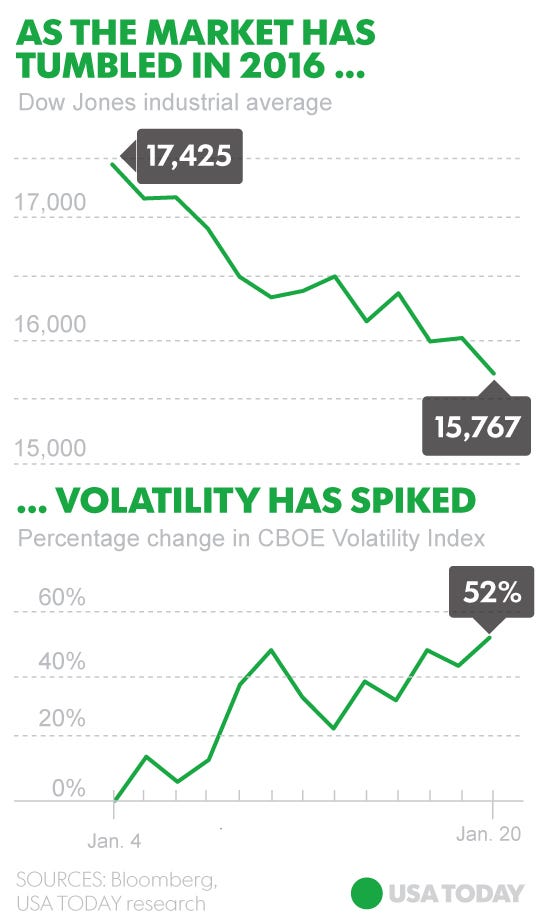

► At one point Wednesday the Dow Jones industrials were down more than 565 points — and off nearly 2,000 points in the first 12 trading days of 2016. The Dow closed down 249 points.

► The VIX, a closely watched Wall Street “fear gauge.” It flashed fear Wednesday, jumping as much as 23% to its highest level since the last big stock swoon back in August.

► The U.S. government bond market saw a torrent of cash pour in — despite the fact the Federal Reserve starting raising interest rates last month — pushing the 10-year Treasury yield below 2% to a three-month low.

So was Wednesday’s wild ride the final capitulation, or selling climax, that Wall Street pros say normally accompanies a short-term market bottom after days and days of brutal selling? Washouts occur when the investing herd hits the point of maximum pessimism and look at the losses in their portfolio and say, ‘That’s enough, I’m getting out” and sell.

It’s still too early to say the market has hit rock bottom, but there are signs panic selling is leading a stampede out of the market that will eventually clear the way for rising prices and a recovery bounce.

“We are probably washed out for now, but nothing is 100% in this environment,” says Gary Kaltbaum, president of money-management firm Kaltbaum Capital Management, adding that stocks could soon mount a counter-trend rally to the upside in what he says is a bear market. Kaltbaum saw signs of rebound coming Wednesday when he says he got a bunch of e-mails from clients asking if they should consider shorting the market — a strategy that makes money when stocks go down — after the Dow had already plunged 2,000 points in 2016. “That’s a clear sign” that selling exhaustion was near, he says.

Adds Andrew Adams, a stock research associate at at Raymond James: “Today has the feel of capitulation,” he told clients in a report, comparing the big whoosh down and big rebound to the market’s big turnaround back in late August after the Dow briefly tumbled more than 1,000 points in a single session, setting up a rebound.

The market has been pure mayhem this year and is one of those times when investors do what other investors are doing.

Asked if the selling is rational or a sign of panic, Lee said: “Somewhere in between.”

The market is starting to price in a lot of bad potential outcomes: A global recession. A U.S. recession (which typically results in a stock market drop of 20% to 30%). Some unknown financial crisis caused by so many different types of assets going down in price. Investors fear central banks can no longer dampen volatility and backstop the market.

The difficult part is that investors are trying to determine if the fallout from plunging oil prices and a slowdown in China will bleed into the U.S. and cause a global recession and drag down the U.S., too. For the moment, the U.S. job market remains strong and consumers are still spending on things like cars.

While Sam Stovall, U.S. equity strategy at S&P Capital IQ, doesn’t think the global economy is headed for recession, the readjustment in the market’s valuation and falling prices was a combination that could cause fear-based selling to accelerate.

“Unfortunately, investors are likely getting to the panic stage and could turn fear into panic causing a washout,” Stovall says.

No doubt fear is in the air on Wall Street.

“The selling is fear based,” says Nick Sargen senior investment advisor at Fort Washington Investment Advisors. Investors, he says, fear defaults in the energy space and commodity exporting countries. “It is rational in that these risks have increased, which is what is being priced into markets.’

But Sargen says he doesn’t want to overreact, as the U.S. economy has proven “remarkably resilient to shocks.” He says U.S. consumers will benefit from lower oil prices. Most important, he believes the “risk of a U.S. recession or financial crisis are low.”

Brian Belski, chief investment strategist at BMO Capital Markets, who correctly predicted a coming correction in his 2016 outlook piece but still thinks the long-term bull remains intact, debunks the bears’ biggest argument: “This is definitely not a financial crisis,” Belski says. “Just because stocks go down does not mean we are in a recession, nor does it mean that we are in a crisis or (markets will be hurt by) contagion.”

Quincy Krosby, market strategist at Prudential Financial, ticks off a few things that could signal the worst is over and bring stability back to the market. The market, she says, wants to see better economic data, stability in oil prices, a rebound in hard-hit small-cap stocks (the Russell 200 small cap index actually rallied 1.3% Wednesday), stocks shooting higher on better-than-expected earnings and a rebound in bond yields that suggests the economy remains strong.

Krosby says investors should be prepared for a violent upswing when stocks turn up.

“Expect buying, when it happens, to be swift as well,” Krosby says. “Buying also begets more buying.”

Link: http://www.usatoday.com/story/money/markets/2016/01/20/stock-market-fear-rises/79067622/

Way to go, G !

Good call Gary!!

However, this volatile January will become more of the rule rather than the exception since Dodd-Frank has effectively taken the big banks out of the picture because they can no longer trade on their own account if I am not mistaken. The days of the fed making a “phone call” to Goldman Sachs are over. Can you imagine what would have happened back in 1893 when J.P Morgan was asked to bail out the banks and he could not do it because of “Dodd-Frank”?? It would not have been pretty.